Apple vs Samsung vs Huawei: Which Brand Should UK Distributors Back in 2025?

In the ever-evolving mobile market, choosing the right brand to stock is crucial for UK distributors aiming to maximize profits in 2025. Among the top contenders — Apple, Samsung, and Huawei — each offers distinct advantages in terms of market demand, profit margin, and after-sale support. While Apple dominates brand loyalty, Samsung appeals with versatility, and Huawei continues pushing innovation at competitive prices. But which brand should UK mobile distributors back this year? This detailed comparison will explore key aspects like popularity, trade-in programs, and resale value to help businesses make informed decisions. Whether you’re in retail or wholesale, this guide is tailored for the modern UK mobile phone distribution landscape.

For wholesale companies like Wholesale Squad, aligning with the right brand can result in higher margins, faster stock turnover, and stronger market presence. This in-depth guide breaks down each brand’s performance in the UK market based on key factors that matter most to distributors.

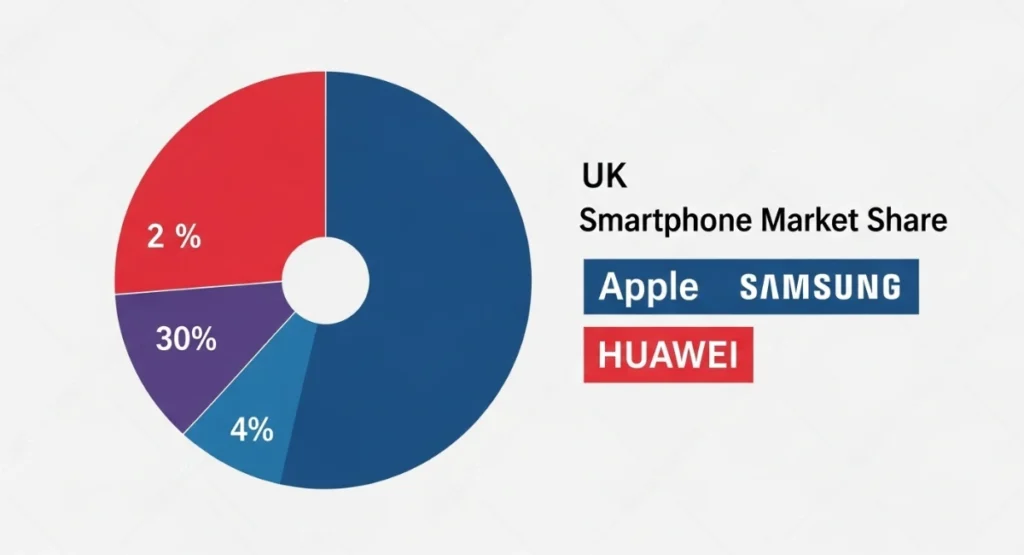

Brand Popularity in the UK Market

The UK market is known for its premium taste, and Apple continues to dominate thanks to strong mobile brand loyalty and unmatched brand trust. iPhones are not just status symbols — they’re reliable, resale-friendly devices backed by a deep product ecosystem. Their presence across retail, online, and telecom channels further solidifies Apple’s control over the UK’s premium segment.

Samsung, meanwhile, appeals to a wider demographic. Its Galaxy lineup offers flexibility, serving both budget-conscious and high-end users. This wide coverage keeps Samsung’s market share consistent. Huawei, after recovering from past sanctions, has begun regaining visibility through competitively priced 5G phones. However, Huawei distributors in the UK still face challenges related to perception, app store limitations, and customer hesitation.

UK Smartphone Brand Preference Snapshot (2025)

| Brand | UK Popularity Level | Consumer Loyalty | Availability Across Channels |

|---|---|---|---|

| Apple | Very High | Strong | Full |

| Samsung | High | Moderate | Full |

| Huawei | Medium | Low | Partial |

Margin Comparison: Apple vs Samsung vs Huawei

Distributors in the UK are profit-focused, and knowing the margin profile of each brand is essential. Apple’s iPhones, although priced high, provide consistent and reliable flagship resale value and low return rates. This creates healthier margins and boosts resale velocity.

Samsung offers balanced margins, especially on its flagship S-series and foldable devices. However, mid-range A-series phones may depreciate faster. Huawei’s aggressive pricing allows for quick volume sales, but returns, price drops, and customer service gaps can eat into margins. UK resellers working with brands like Wholesale Squad must balance quick sales against long-term profit security.

Wholesale Margin Comparison Table (UK Distributors – 2025)

| Brand | Avg. Margin (Premium Devices) | Avg. Margin (Mid/Budget Devices) | Resale Velocity |

|---|---|---|---|

| Apple | 18–22% | 12–15% | High |

| Samsung | 15–19% | 9–12% | Moderate |

| Huawei | 10–13% | 6–8% | Low |

5G & Flagship Trends in 2025

Flagship smartphones define a brand’s identity in the UK market. In 2025, Apple’s iPhone 15 Pro and Pro Max bring in faster chipsets, longer battery life, and AI-driven features that outperform most Android phones. These innovations increase demand and justify higher price points.

Samsung’s Galaxy Z Fold and S-series focus on futuristic design, enhanced camera systems, and powerful multitasking, making them attractive to productivity-focused users. Huawei’s Mate and Nova series offer flagship-like specs at mid-tier prices, but lack the polished ecosystem lock-in Apple provides. This gap affects brand loyalty and consumer demand elasticity.

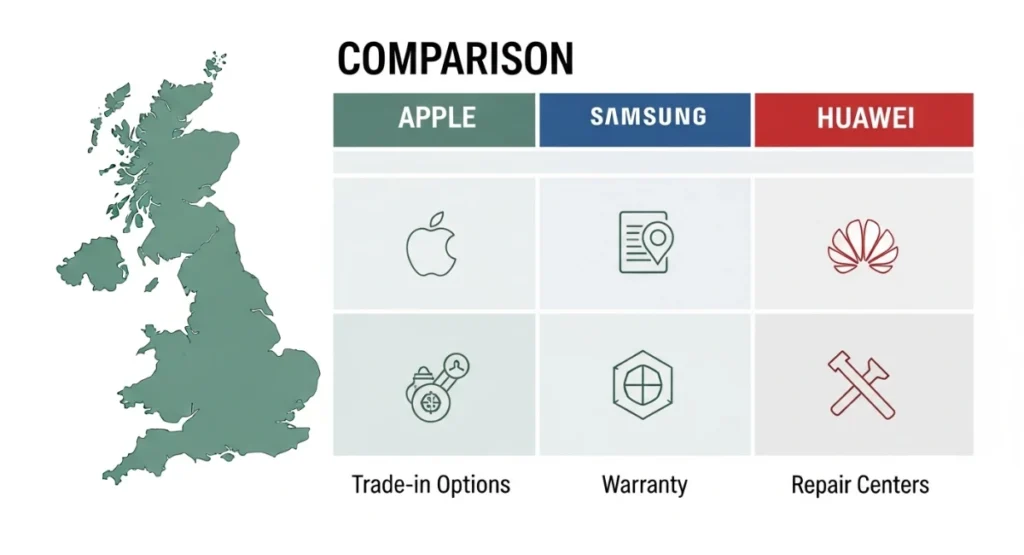

Who Offers Better Trade-in & After-Sale Support?

Trade-in and after-sale service can make or break a brand’s trust in the UK. Apple has a highly established iPhone trade-in programme in the UK through both direct channels and partners. Their AppleCare system and easy Genius Bar access improve post-purchase satisfaction and reduce churn.

Samsung offers decent after-sales services, especially via its Smart Switch tools and service centres. Their trade-in values are moderate. Huawei, however, continues to face challenges due to limited UK service locations and slower repair processes. UK-based distributors like Wholesale Squad need reliable after-sale policies to maintain B2B and B2C relationships.

Brand Support & Trade-In Comparison (UK Focused)

| Brand | Trade-In Program Availability | After-Sale Service Quality | Return/Repair Speed |

|---|---|---|---|

| Apple | Widely Available | Excellent | Fast |

| Samsung | Available | Good | Moderate |

| Huawei | Limited | Average | Slower |

Price Stability & Resale Value

Apple phones maintain value longer than any other brand in the UK. This is crucial for bulk buyers who want to avoid sudden price crashes. Even after 6–12 months, Apple’s resale value remains high, which means less risk for distributors and more consistent cash flow.

Samsung’s premium phones also perform well in resale but drop faster in the mid-tier category. Huawei’s fast depreciation rates and limited trade-in value present a higher risk. For businesses like Wholesale Squad, maintaining price stability reduces markdown pressure and stock aging problems.

Software Ecosystem & Customer Retention

Apple’s ecosystem lock-in is a major strength in the UK. Most users who buy an iPhone eventually buy other Apple products like MacBooks or Apple Watches. This interconnected user experience builds mobile brand loyalty and increases repurchase rates.

Samsung’s One UI, built on Android, offers a good experience but doesn’t guarantee loyalty. Users often switch brands after 2–3 years. Huawei, with HarmonyOS, is developing its ecosystem, but UK buyers remain cautious. This affects repeat purchase behaviour and lowers long-term retention for Huawei distributors.

Final Verdict: Which Brand Should UK Distributors Back in 2025?

There is no one-size-fits-all answer — each brand serves different segments in the UK. If you’re a UK distributor or wholesaler like Wholesale Squad, the brand you choose depends on your sales strategy.

Choose Apple if you want high resale velocity, loyal customers, and strong channel incentives. Samsung is great for versatility and innovation, especially in mid and upper-mid segments. Huawei, while profitable short term due to low entry cost, comes with risk and low after-sale support in the UK.

Final Brand Comparison Table (UK Distributor View)

| Brand | Best For | Ecosystem Strength | Trade-In Support | Overall Risk |

|---|---|---|---|---|

| Apple | Premium market, high loyalty | Strong | Excellent | Low |

| Samsung | Mid-range flexibility, innovation | Moderate | Good | Medium |

| Huawei | Budget segment, fast turnover | Weak | Basic | High |

For UK distributors focused on brand trust, profit margins, and resale strength in 2025, Apple is the safest investment. However, including selected Samsung and Huawei units may help balance your catalogue — if you manage inventory smartly.